BHIM Digital POS

BHIM DITGITAL POS – UPI & Aadhaar Pay App for Merchants

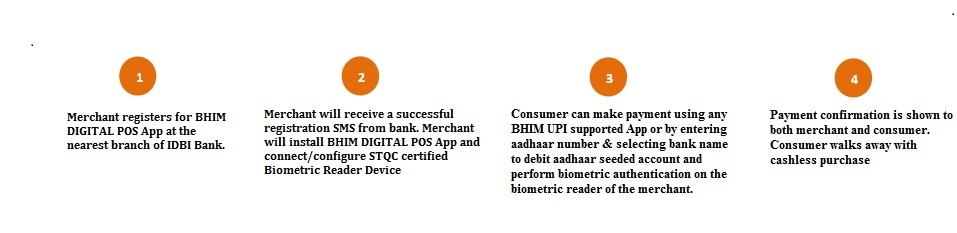

BHIM DIGITAL POS is one stop Mobile First Point of Sale Application that empowers merchants to accept cashless payments from BHIM UPI Apps and Aadhaar seeded accounts of consumers,on 24x7 days basis, without any hassle of installing complex hardware infrastructure.

Salient features:

- Any entity maintaining an operative account with IDBI Bank can become BHIM DIGITAL POS merchant.

- No setup fee incurred by merchant.

- Merchant’s Smart Phone becomes a Terminal for acceptance

- Bank can also provide API/SDK, on select basis, to ecommerce giants, payment aggregator and corporate clients so that they can provide “Pay by UPI” facility to their customers on websites and inside their own Mobile Apps.

- With IDBI DIGITAL POS multiple Terminals can be created for single merchant, thereby helping merchant to create multiple collection point across Store and Geographies.

- Facilities for the merchants to print the QR code online and stick the QR code at cash counters and start accepting payments.

- Facilitates real time credit of funds in merchants’ bank account.

- Enables Merchant to accept payment from Aadhaar seeded account of payer using biometric authentication.

- STQC certified Biometric Devices for capturing payer’s fingerprint for Aadhaar Pay transactions can be provided by IDBI Bank.

- Enables Merchant to accept payment from any BHIM UPI App or Third Party UPI supported Apps for example Phonepe,BHIM,Tez,SBI Pay,WhatsApp, PayWizetc.

- Merchant need not open any separate settlement account.

- The per transaction limit is Rs.10,000/- fromAadhaar Pay.

- Detail dashboard available for merchants to view reports, raise incidences and perform analytics.

- Safe and Secure technology complying with necessary NPCI and statutory guidelines.

Requirements for the Merchant to Start BHIM Digital PoS:

The merchant needs to have the following to start using BHIM DIGITAL POS:

- An operative bank account with IDBI Bank

- STQC Certified Biometric Reader with Micro USB / USB C-Type connector. Merchant can procure biometric reader from IDBI Bank.

- Android smartphone with internet connectivity and OTG support for connecting biometric device

- Android version 5.0 or higher

- Phone should be able to power the biometric reader; please check with supplier.

For details on installation and service fees, please contact nearest branch of IDBI Bank Ltd

.jpg)

BHIM-DITGITAL-POS-UPI-_-Aadhaar-Pay-App-for-Merchants.jpg)